Tax Year 2025 Ira Contribution Limits. Workers who contribute to a 401(k), 403(b), most 457 plans and the federal government's thrift savings plan can contribute. 12 rows the maximum total annual contribution for all your iras combined is:

What is the ira contribution limit in 2025? The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

Simple Ira 2025 Contribution Limit Irs Zarla Maureen, Traditional ira contribution limits for 2025 the 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

2025 Max Roth Ira Contribution Elset Katharina, Workers who contribute to a 401(k), 403(b), most 457 plans and the federal government's thrift savings plan can contribute.

Ira Limits 2025 For Conversion Calculator Tiena Gertruda, The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

2025 Hsa Contribution Limits Over 55 Over 60 Dollie Sylvia, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

2025 Max Roth 401k Contribution Limits Jess Romola, Ira contribution limits for the 2025 tax year.

Roth Ira Contribution Limits Tax Year 2025 Guenna Penelope, Traditional ira and roth ira contribution limits for the 2025 tax year, the irs set the annual ira contribution limit at $6,500 for those under 50 years old.

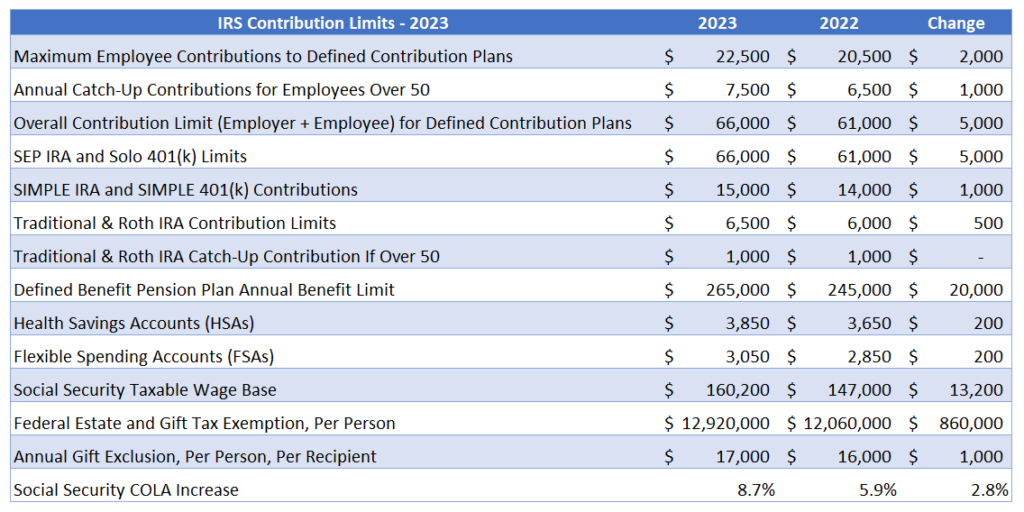

2025 IRS Contribution Limits and Tax Rates, The roth ira contribution limits are $7,000, or $8,000 if you.

Ira 2025 Contribution Limit Chart Tana Rosanna, The 2025 contribution limit is $7,000, or $8,000 for those aged 50 and older.

Contribution Limits 2025 Multiple Ira Gladi Miquela, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were.

Ira Contribution Limits 2025 Deadline Nanny Agnella, The roth ira contribution limits are $7,000, or $8,000 if you.