Standard Deduction For 2025-24. Here you will find federal income tax rates and brackets for tax years 2025, 2025 and 2025. Tax brackets and rates 2025, 2025, 2025.

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, 24(b) interest on borrowed capital (rs. This is a $750 increase from the 2025 deduction of $13,850.

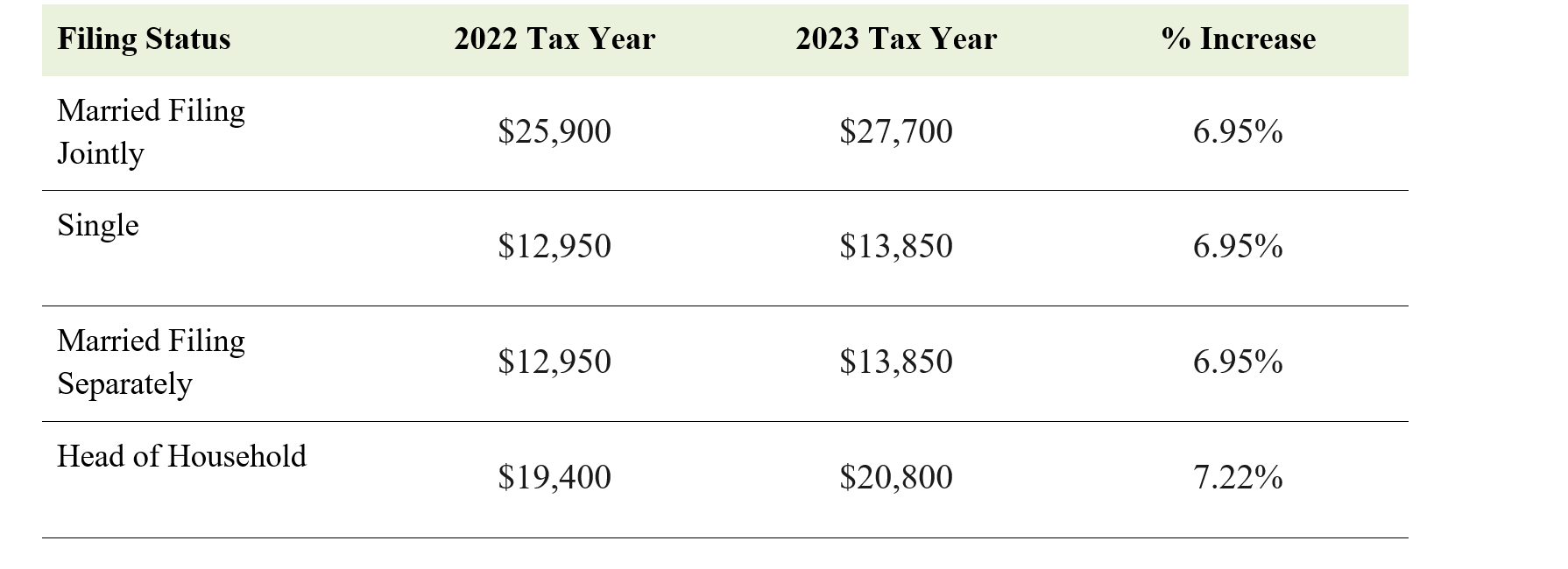

What Is the Standard Deduction? [2025 vs. 2025], The larger 2025 standard deduction is $14,600 for individuals, up $750 from the 2025 amount. The standard deduction is the fixed amount the.

Serene Financial Solutions Financial Planning and Investment Management, For 2025, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,300 or the. The additional standard deduction amount will increase to $1,950 if the individual is.

![What Is the Standard Deduction? [2025 vs. 2025]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg)

Standard Deductions for 20232024 Taxes Single, Married, Over 65, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). Seniors over age 65 may claim an additional standard.

Standard Deduction 2025? College Aftermath, 24(b) interest on borrowed capital (rs. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Are You Taking Advantage of These Print Related Business Tax Deductions, For individuals, the new standard deduction is $14,600. For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2025, an increase of $750 from 2025;

Compare Before Deciding on the Standard Deduction Martha May North, The additional standard deduction amount will increase to $1,950 if the individual is. For single taxpayers and married couples filing individually, the standard deduction is increasing $750 from 2025 to bring the total deduction to $14,600 for 2025, according.

IRS Standard Deduction 2025, Standard Deduction Calculator, In addition to tax brackets, standard deductions are another critical component of the tax code. This is a $750 increase from the 2025 deduction of $13,850.

Should I Take The Standard Deduction or Itemize? The Oasis Firm, The additional standard deduction amount will increase to $1,950 if the individual is. The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $.

New Tax Regime Complete List Of Exemptions And Deductions Disallowed, In addition to tax brackets, standard deductions are another critical component of the tax code. The federal standard deduction for a married (separate) filer in 2025 is $ 14,600.00.

The standard deduction was raised in addition, for married couples filing jointly, the standard deduction was increased 5.4% to $29,200, making it more.

For single taxpayers and married couples filing individually, the standard deduction is increasing $750 from 2025 to bring the total deduction to $14,600 for 2025, according.